Insurance companies do not directly report to Carfax, but this doesn’t mean Carfax doesn’t get information on insurance claims and reports. While insurance companies do not report to Carfax directly, information on insurance claims and records may end up on Carfax through other channels.

Do insurance companies report to Carfax? Let’s find out more about how Carfax gets access to vehicle history.

Carfax Overview: What is Carfax?

Carfax is a widely recognized and trusted provider of vehicle history reports in the automotive industry. These reports are accessible with the VIN and offer valuable insights into a vehicle’s past, helping consumers and businesses make informed decisions when buying, selling, or maintaining vehicles.

In the used car market, Carfax and other vehicle history report providers hold great importance because they can help buyers verify a vehicle’s condition and avoid bad ones. They also help sellers and dealers have proof of their vehicle’s overall performance and condition.

However, sometimes consumers aren’t really happy with their reports as they may end up reducing their trade-in values and overall value of their vehicles, sometimes even more than 10%. So, it causes a lot of them to wonder, Do insurance companies report to Carfax? No, but we will discuss this further in other sections.

How Carfax Collects Vehicle Information

So many people want to know what companies report to Carfax. Carfax says they get their information from 139,000 different sources across the US and Canada. They primarily gather vehicle history information from various sources such as state DMVs, police records, auto auctions, and service and repair facilities.

Other Carfax data sources are:

- Motor vehicle agencies in the US

- Canadian provincial motor vehicle agencies

- Car Insurance companies

- Salvage auctions

- Automotive recyclers

- Rental/fleet vehicle companies

- State inspection stations

- Fire department

- Manufacturers

- Dealerships

- Import/export companies, and others.

The Role of Insurance Companies in History Reports

While insurance companies don’t typically report directly to Carfax, their involvement indirectly impacts the information included in Carfax reports.

- Handling Insurance Claims: When a vehicle is involved in an accident and an insurance claim is filed, the auto insurance company assesses the damage and facilitates the repair process. During this process, the insurance company documents details of the accident, including the date, location, extent of damage, and any injuries sustained. This information is crucial for processing the damage claim and determining liability.

- Record-Keeping: Insurance companies maintain detailed records of insurance claims, including information about the vehicles involved, the nature of the accidents, and the outcomes of the claims. These records are used for internal purposes such as claim processing, risk assessment, and underwriting.

If they don’t report, how does it get out to Carfax? Let’s take a look at an example. Let’s say a vehicle is involved in a significant accident and a comprehensive insurance claim is filed, the repair history and extent of damage may be documented by service and repair facilities.

This information can then be obtained by Carfax from these third-party sources, such as repair shops or auto body shops, rather than directly from the insurance company.

Will insurance companies add a record to the Carfax if they only pay for the repair?

If the insurance company planned on reporting the repair to Carfax, they would even if you don’t get it repaired with their authorized shop. As long as there was a car accident and they wanted to report it, you’ll definitely find it on the Carfax report. Don’t forget the auto repair shop you use could also report the information to Carfax.

What triggers an "accident" report on CARFAX?

An accident report cannot appear on Carfax if the accident wasn’t reported in the first place. Here are some ways an accident can get reported:

- Police on the Scene: Accidents involving police reports are prime candidates for Carfax inclusion. These reports detail the crash and potential damage.

- Repair Shops: Body shops, especially large chains, may transmit collision repair data to Carfax. This can trigger an “accident” label.

- Severity Matters: Not all bumps get reported. Minor accidents, especially those settled privately with minimal damage, might fly under the Carfax radar and might come out with a clean Carfax report.

If you have a minor scratch, you can speak with the auto repair shops and find out if it would trigger an accident label with Carfax or any other vehicle history provider.

Now you understand how Carfax vehicle history reports contain accident records. While insurance providers don’t report accidents to Carfax directly, there’s a high chance that the records may get reported to Carfax.

What does an Accident Report look Like

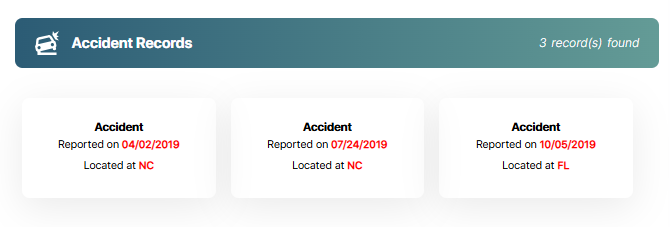

An accident report typically includes key details such as the number of accidents, date and location of the incident, a description of the damage, the severity of the accident (minor, moderate, or severe), airbag deployment status, and police involvement.

Here are a few sample reports to give you an idea:

Vehicle Data APIs for Business Owners

Carfax gather their information themselves, what if you could just gain full access to a database and provide accurate vehicle information to consumers? Vehicle databases provides the Vehicle History API, the top Carfax API alternative. With this API, businesses can rebrand and resell vehicle history reports to their customers using our data. This data includes:

- Accident records

- Theft records

- Damage records

- Auction records

- Sales history

- Title brand records

- Service and repair records

- Ownership records

- Mileage readings

- Lien and loan records

- Market value

- Recalls

- Warranty status, and more

If you run a business in need of vehicle information and detailed records, try out the Vehicle History API for free. We offer 15 credits to new, registered users and you can book a demo at any time. Get detailed reports today!

Do insurance companies report to Carfax? Now you know the answer! Although they don’t report directly, there are other means for insurance claims and data to get to Carfax.

Frequently Asked Questions

Does CARFAX get information only from insurance companies?

No, Carfax gathers information from a wide range of sources, not just insurance companies. They collect data from 139,000 different sources across the US and Canada, including state DMVs, police records, auto auctions, service and repair facilities, salvage auctions, rental/fleet vehicle companies, manufacturers, dealerships, and more.

Do every car accident always show up on Carfax?

Some accidents may never get reported to Carfax, and as such may not end up on reports. However, accidents involving reports from Police departments or significant damage repaired by body shops, especially large chains, are prime candidates for inclusion on Car fax reports.

What are 5 things you could find in a CARFAX history report?

In a Carfax report, you can typically find:

- Accident history, including the severity of damage and repairs.

- Title history, indicating any salvage, rebuilt, or flood titles.

- Odometer readings to check the right detect potential odometer tampering.

- Service and maintenance records, documenting routine maintenance and repairs.

- Theft records.

What triggers an "accident" report on CARFAX?

Accident reports on any car’s Carfax are triggered by various factors, including:

– Police reports detailing the crash and potential damage.

– Collision repair data transmitted by body shops, especially large chains.

– Severity of the accident, as not all incidents are reported.

– Minor accidents with minimal damage may not be included in Carfax reports.

What does Carfax show in a vehicle history report?

Carfax shows details such as ownership history, title status, accident records, service history, and more. Understanding what Carfax shows can help you avoid vehicles with hidden problems.

Do body shops report to Carfax after repairs?

Some body shops do report repairs to Carfax, especially if they’re affiliated with insurance claims. These updates often appear in the car damage report, giving buyers insight into a vehicle’s repair history.